Ideas:

- Gold costs may redress bring down in the midst of hazard on exchange having surged after FOMC

- Raw petroleum costs turn income reports from industry heavyweights for direction

Old costs surged in the wake of a FOMC declaration that the business sectors translated as tentative. The US Dollar fell close by Treasury security yields after the approach articulation crossed the wires, boosting the relative interest of non-enthusiasm bearing and against fiat resources.

Looking forward, a break in top-level news stream may see energy moderate until second-quarter US GDP figures enter the photo Friday. S&P 500 prospects are pointing carefully higher, so somewhat of a remedial pullback might be likely to work out if financing costs edge up a bit in chance on exchange.

Unrefined petroleum costs stamped time, unaffected as EIA stock information demonstrated a bigger than-anticipated drawdown. The figures indicated stores shedding 7.21 million barrels a week ago though investigators expected a 3.13 million surge. The manageable reaction presumably owed to API transmitting a huge drop yesterday.

Income reports frame a portion of the vitality segment's driving firms now enter the spotlight. ConocoPhilips, Valero and Marathon are among the organizations because of report in the coming hours. Dealers will go over the organizations' forward direction proclamations to advise supply/request slant desires.

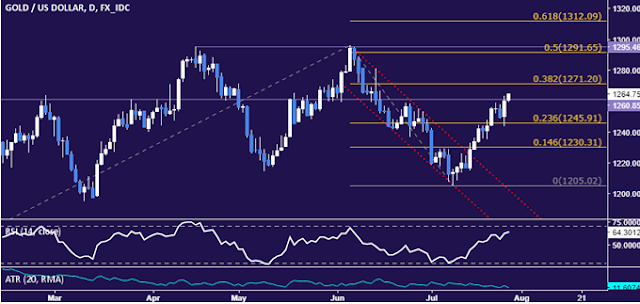

GOLD TECHNICAL ANALYSIS – Gold costs are trying above outline expression point bolster at 1260.85, with a break higher opening the entryway for a trial of the entryway for a trial of the 38.2% Fibonacci extension at 1271.20. Past that, the 1291.65-95.46 zone (half level, twofold best) comes into center. On the other hand, a turn underneath the 23.6% Fib at 1245.91 uncovered the 14.6% development at 1230.31 once again.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil costs have slowed down close resistance at 48.65, the half Fibonacci retracement. A managed push over this hindrance sees the following upside edge at 50.19 (61.8% level, slant line). On the other hand, an inversion back underneath the 38.2% Fib at 47.10 uncovered help at 45.32.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

No comments:

Post a Comment