Ideas:

- Crude oil costs break 2-week extend floor regardless of energetic API information

- Gold costs withdraw from 9-month has North Korea stresses fail

- Modified US Q2 GDP, ADP occupations information may help Fed rate climb wagers

Crude oil costs kept on retribution with the effect of Tropical Storm Harvey. The WTI benchmark at first confronted offering weight in the midst of proceeded with worries that storm instigated refinery shutdowns will undermine endeavors to work through a supply overabundance, reverberating yesterday's value activity.

That story appeared to change however as in the midst of reports that crude material makers may react to waiting pipeline interruptions by decreasing yield. That appeared to start an intraday bob, however this was to be fleeting even as API detailed a stock drawdown of 5.78 million barrels a week ago.

Official EIA stock insights are currently on tap, with middle gauges indicating a more unobtrusive 1.9 million barrel outpouring. A perusing nearer in accordance with API information may offer a level of help yet the business sectors' lukewarm reaction to that figure appear to imply that Harvey-related advancements will stay in center.

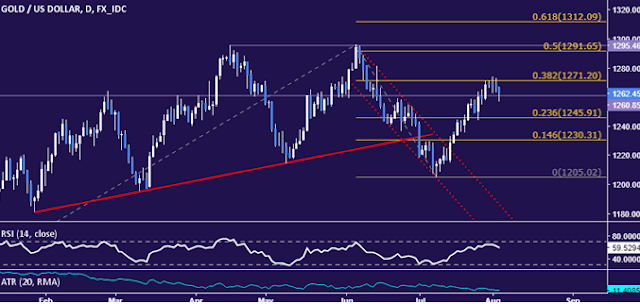

Gold costs withdrew after quickly touching the most abnormal amount in nine months. The surge trailed North Korea directed another rocket test however the prominent nonattendance of "flame and fierceness" with respect to the US from there on appeared to quiet financial specialists.

This most likely puts Fed arrangement hypothesis to the bleeding edge for the yellow metal. A reconsidered set of second-quarter US GDP figures and the ADP gage of private payrolls development may sent it lower if wagers on mellow enhancements are bested, resounding progressively perky US monetary news-stream since mid-June.

Seeking For best Trading Recommendation, If Yes Then find out here CRUDE OIL SIGNALS

GOLD TECHNICAL ANALYSIS – Gold costs prominently neglected to affirm a break over the 38.2% Fibonacci extension at 1311.94 and negative RSI dissimilarity focuses to ebbing upside force, indicating a turn lower might be ahead. Crushing spirit beneath resistance-turned-bolster at 1295.46 uncovered the August 25 low at 1275.34. On the other hand, a move back over 1311.94 opens the entryway for another trial of the half extension at 1323.25.

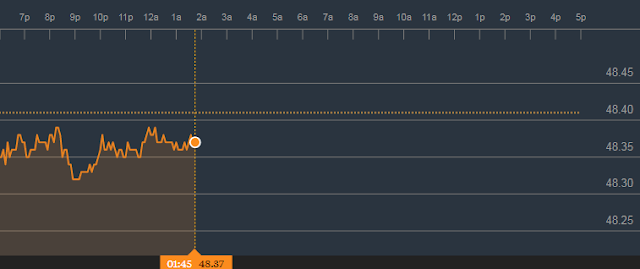

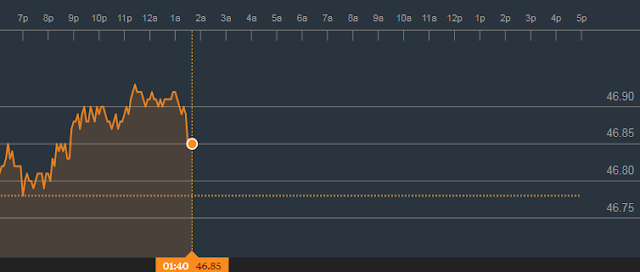

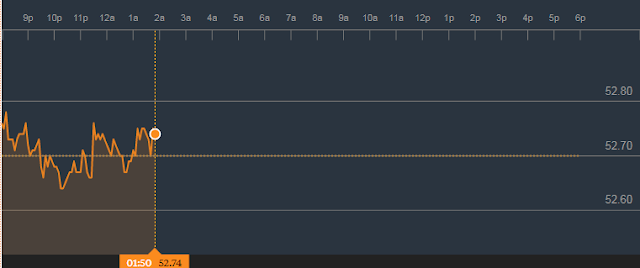

CRUDE OIL TECHNICAL ANALYSIS – Crude oil costs, at last, settled what to do in the wake of burning through two weeks stuck in a thin range, getting through help to uncover the half Fibonacci development at 45.46. A day by day close beneath this boundary sees the following significant edge in the 42.08-84 zone (June 21 low, 76.4% level). On the other hand, a move back over the 38.2% Fib at 46.62 targets bolster turned-resistance at 48.76 once again.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

Commodity recommendations, commodity tips, Crude Oil tips, crude oil trading signals, crude oil signals