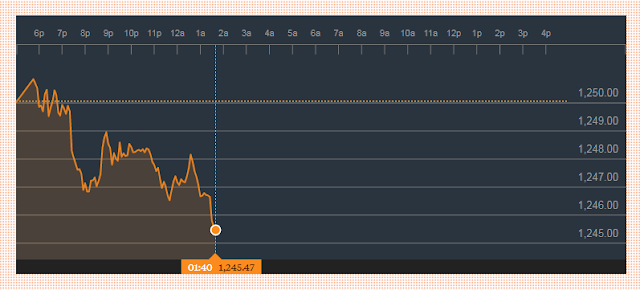

Gold costs fell beneath the 50-DMA level of $1249.45 and stretched out misfortunes to $1246 (23.6% Fib R of $1204.70-$1258.79) as the political help in Washington reinforced the US dollar.

Bearish inversion affirmed

Bearish value activity following Monday's Doji flame shows that the rally from the July 10 low of $1204.70 has bested out. The yellow metal is exchanging under weight this Wednesday morning on indications of USD quality and in the midst of alert in front of the Fed minute discharge. The facilitating of political instability helped the dollar list recoup from the low of 93.64 in the overnight exchange.Concentrate on Fed minutes

Kathy Lien from BK Asset Management states, "With US stocks moving to new record highs, there's almost no purpose behind the Fed to change its tune. The positives will most likely exceed the negatives, making the dollar expand higher post FOMC yet the increases won't last as financial specialists still inquiry the solidness of US information". Gold could broaden misfortunes if the dollar strengthens post Fed minutes.Gold Technical Levels

A break beneath $1246.02 (23.6% Fib R of $1204.70-$1258.79) would open up drawback towards $1239.97 (June 29 low) and $1236.37 (June 26 low). On the higher side, break of obstacle at $1249.45 (50-DMA) would open entryways for $1254.88 (June 28 high) and $1258.79 (July 24 high).

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

No comments:

Post a Comment