Arguments:

- Gold value drop stops as Fed rate climb theory delays

- Uptick in US PCE expansion gage may resuscitate down move

- Crude oil costs drop to help as bounce back endeavor misfires

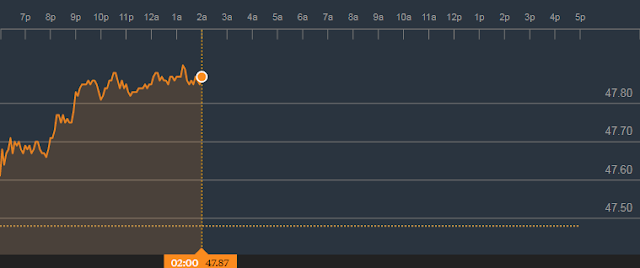

Gold costs mounted a lukewarm recuperation as the upturn in Fed rate climb hypothesis that has characterized value activity for a significant part of the week stopped to merge. The US Dollar backtracked some of its current picks up nearby front-end Treasury security yields, disregarding a cheery second-quarter GDP modification. Maybe the print was regarded excessively dated, making it impossible to impact close term strategy wagers and brokers decided on benefit taking.From here, the Fed's favored PCE gage of US expansion comes into center. The on-year development rate is required to tick up to 1.5 percent in August, denoting the primary increment in a half year. Practically equivalent to CPI information distributed two weeks back outperformed accord estimates. In the event that that demonstrates to have foreshadowed a comparably ruddy PCE result, the work in rate climb wagers may resume to the drawback of the yellow metal.

Crude oil costs were taken for a wild ride. Beginning additions were apparently activated by Turkey's consent to confine Iraqi oil trade rights to the focal government. The previous nation is home to a noteworthy pipeline outlet from the last mentioned. This takes after the Kurdish freedom submission restricted by both Baghdad and Ankara. This may lessen worldwide supply by constraining streams from Kurdish-controlled northern Iraq.

The move higher failed in breathtaking design be that as it may, with the WTI benchmark not just eradicating the greater part of its initial session picks up yet tumbling to complete with its most noticeably bad single-day drop in three weeks. Costs' powerlessness to benefit from strong stock information addressed critical basic shortcoming. It is conceivable that the death of the week's load of major booked occasion chance opened the entryway for that to wind up plainly noteworthy.

The week after week report from tanker-following firm Oil Movements may have exacerbated offering weight. It said that OPEC shipments will ascend to 23.96 million barrels in the a month to October 14 from the earlier month. Unsurprisingly, shipments shape the Middle East were predicated to fall in a similar period. This may have flagged the failure of the Iraq/Turkey accord to move the needle on the worldwide supply excess.

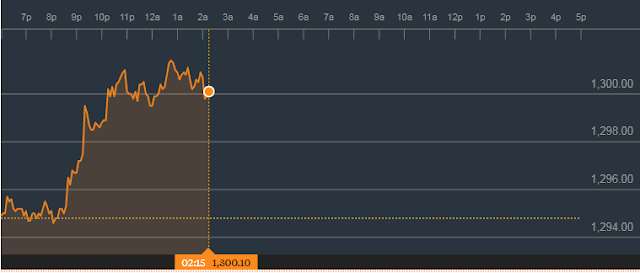

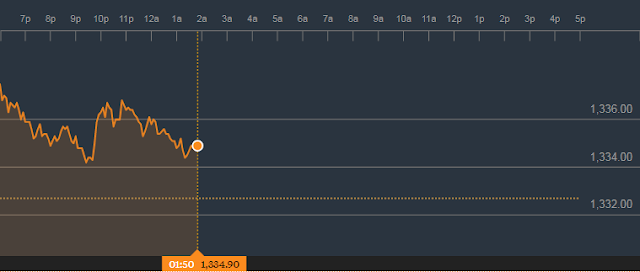

GOLD TECHNICAL ANALYSIS – Gold costs stopped to solidify misfortunes above help set apart by the half Fibonacci extension at 1279.01. A break underneath that affirmed on a day by day shutting premise focuses on the 61.8% level at 1270.84. On the other hand, a turn back over the September 21 low at 1288.28 makes room for another test of the 23.6% Fib at 1297.28.

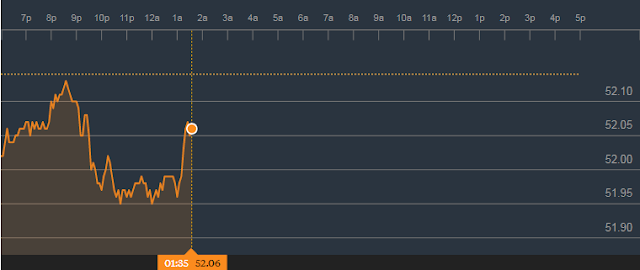

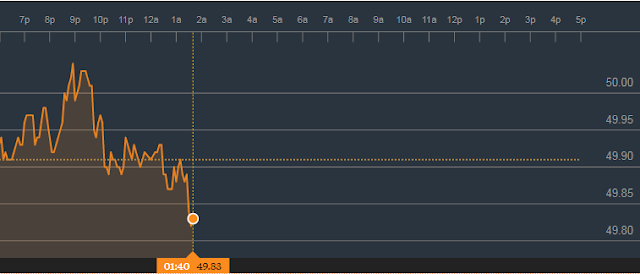

CRUDE OIL TECHNICAL ANALYSIS – Crude oil costs are trying help at 51.26, the 14.6% Fibonacci retracement. The obstruction is fortified by a pattern line characterizing the month to month uptrend. A day by day close beneath that uncovered the 23.6% level at 50.29. Then again, a move over the September 28 high at 52.83 opens the entryway for a retest of the 53.74-54.48 territory.