Gold costs bounced back this week with the valuable metal revitalizing 1.33% to exchange at 1228 in front of the New York close on Friday. The progress has been upheld by proceeded with the shortcoming in the greenback with the DXY down over 0.7%.

The June Consumer Price Index (CPI) and Retail Sales figures came in short of agreement appraises on Friday, energizing another auction in the dollar. The information returns on the of the current week's semi-yearly Humphrey Hawkins declaration before congress where Fed Chair Janet Yellen refered to a more hesitant attitude toward fiscal strategy. The advisory group judged that "on the grounds that the unbiased rate is presently very low by verifiable benchmarks, the government reserves rate would not need to rise all that significantly further to get to a nonpartisan approach position." in the meantime, Yellen invited additionally facilitating measures should economic situations weaken.

The critique recommends that while the Fed sees the economy gathering pace, Yellen and Co might be worried that the national bank will do not have the ammo to react to another emergency given the present arrangement position moving the concentration to the asset report off-stack. Thusly, markets have seen a slight re-estimating in desires for a December climb with Fed Fund Futures now valuing a 39% probability for a 25bps increment in the benchmark loan fee. U.S. information is light one week from now and at gold costs, the attention stays on the sharp inversion seen for this present week off help.

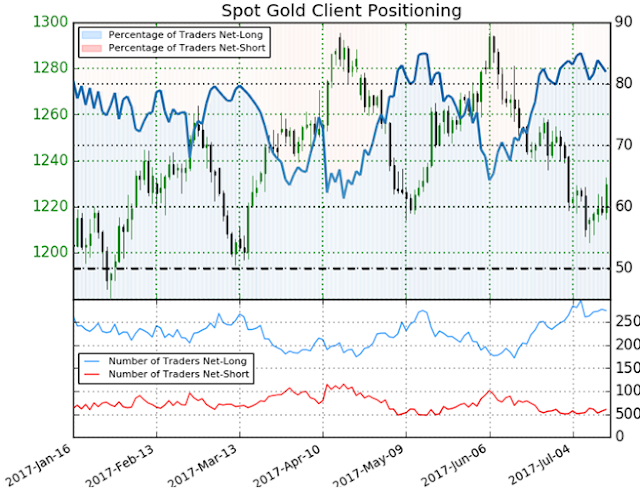

- A synopsis of IG Client Sentimentshows brokers are net-long Gold - the proportion remains at +4.55 (82.0% of merchants are long)- bearishreading

- Long positions are 0.4% higher than yesterday however 5.6% lower from a week ago

- Short positions are 4.7% higher than yesterday and 5.2% higher from a week ago

- While more extensive retail assessment keeps on pointing lower, situating is less net-long than yesterday and contrasted and last week.The late changes in notion caution that the present value pattern may soon turn around higher regardless of the reality brokers stay net-long. All things considered, I would be searching for help on a pullback in cost.

A week ago we noticed that, "the break underneath essential trendline bolster stretching out off the late-January lows moves the medium-term center lower in gold costs with the decrease now testing introductory help at the conjunction of the half retracement and the late-February low-day/low-week close at 1204/09." That help zone held into the begin of the week with beginning week by week resistance seen around ~1240. A rupture above parallel resistance reaching out off the 2016 highs would be expected to check resumption of the more extensive uptrend.

"Day by day resistance remains with the 50-line/200-day moving normal/June 26th swing low at 1232/35." We're trying that level into the end of the week with a break here focusing on the month to month open (1241) sponsored by the upper middle line parallel/100-day moving normal at ~1247. More extensive bearish refutation remains at 1258.

To know our latest recommendation on crude oil trading tips along with stop loss and target price visit http://www.mmfsolutions.sg/

comex-commodity-tips, Commodity recommendations, commodity tips, Crude Oil tips, crude oil trading signals, gold signals, gold tips

No comments:

Post a Comment