Gold costs bounced back in Asia on Wednesday as speculators saw late decreases on a stasis in pressures on the Korean promontory as an opportunity to purchase and on physical request as the Indian celebration season approaches.

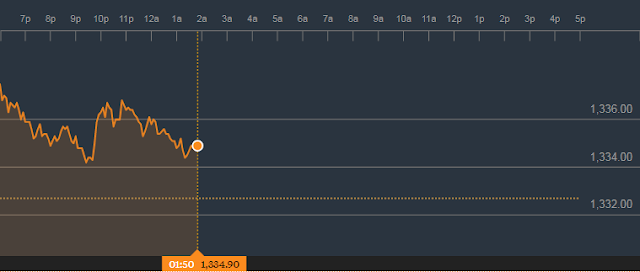

Gold fates for December conveyance on the Comex division of the New York Mercantile Exchange rose 0.33% to $1,337.04 a troy ounce. India and China compete for the title of the world's best gold purchasers and shippers.

Overnight, gold costs fell underneath make back the initial investment on Tuesday as facilitating U.S.- North Korea pressures energized interest for less secure resources lifting worldwide stocks to record highs for a moment straight day.

The help rally proceeded for a moment straight day, bringing down interest for place of refuge gold as speculators disregarded new dangers from North Korea after the United Nations forced a new round of approvals, confining the nation's entrance to oil imports while constraining material fares.

North Korea's envoy to the UN, Han Tae Song, told a meeting in Geneva: "The imminent measures by DPRK [the Democratic Republic of Korea] will influence the US to endure the best torment it has ever experienced in its history."

Additionally weighing on gold costs was a sharp ascent in U.S. treasury yields in front of expansion information due Wednesday, which could impact the Federal Reserve's loan cost choice slated for September 20.

Gold is touchy to moves in U.S. rates, which lift the open door cost of holding non-yielding resources, for example, bullion.

Examiners, nonetheless, have rushed to make light of gold's poor begin to the week as information indicating a surge in purchasing movement proposes that interest for the yellow metal stays upheld.

Net bullish wagers on gold rose to 245,300, the most noteworthy in almost a year, as indicated by a report from the Commodity Futures Trading Commission (CFTC) on Friday.

No comments:

Post a Comment