Crude oil costs fell in Asia with the business sectors still upheld by free market activity essentials and with the U.S. advertise peered toward for new request prompts if the Trump organization figures out how to pass a huge tax reduction.

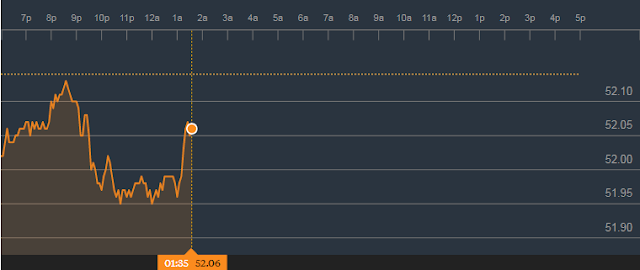

On the New York Mercantile Exchange crude prospects for November conveyance fell 0.36% to $51.95 a barrel, while on London's Intercontinental Exchange, Brent lost 0.42% to $57.33 a barrel.

Overnight, crude oil costs settled higher on Wednesday, as merchants cheered information demonstrating a surprising attract U.S. crude supplies indicating a recuperation in refinery movement and fares following disturbances because of Hurricane Harvey in August.

Crude costs at first attempted to exploit a report from the Energy Information Administration (EIA) indicating crude stores out of the blue fell a week ago as financial specialists measured the plunge in crude reserves against an ascent in gas inventories without precedent for a month.

Inventories of U.S. crude fell by about 1.9m barrels in the week finished Sept. 22, bewildering desires of an ascent of 3.4m barrels.

Fuel inventories, one of the items that crude is refined into, ascended by around 1.107m barrels, missing desires of a draw of 921,000 barrels while distillate reserves fell by 814,000 barrels, beneath desires of a decrease of 2.2m barrels.

The attract U.S. crude inventories comes against a three-week work of reserves as refinery shutdowns because of Hurricane Harvey weighed on interest for crude oil, the essential contribution at refiners.

The break in refinery movement has since enhanced while the extending spread, amongst brent and crude oil costs to almost $6 kept on driving fares, supporting crude oil costs.

The U.S. sent out a record 1.5m barrels for every day of crude oil a week ago, the EIA said Wednesday, an aggregate bigger than the yield of a few Opec part nations.

No comments:

Post a Comment