Crude oil costs fell in Asia on Tuesday in front of industry gauges by the American Petroleum Institute (API) of the refined item and crude stocks in the U.S.

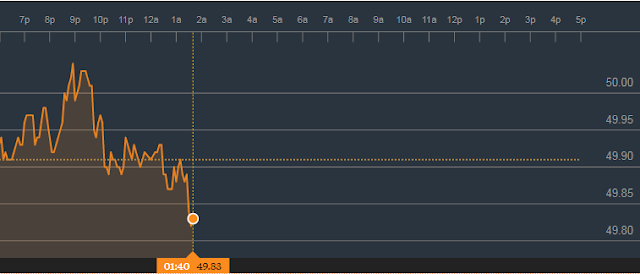

On the New York Mercantile Exchange crude fates for October conveyance fell 0.04% to $50.33 a barrel, while on London's Intercontinental Exchange, Brent plunged 0.18% to $55.38 a barrel.

Experts expect a 2.925 million barrels work in crude and a 2.025 million barrels decrease in fuel and a 1.175 million barrels fall in distillates. On Wednesday, official information from the Energy Information Administration EIA) is expected. The API adn EIA figures regularly separate.

Overnight, oil costs settled higher on Monday as speculators disregarded desires that U.S. crude reserves are set to demonstrate a work for the third week in succession, following the consequence of Hurricanes Harvey and Irma.

Notwithstanding U.S. refineries revealing a vastly improved recuperation from the current tropical storms, financial specialists supported for an uptick in crude supplies as the U.S. increase imports at revived ports to compensate for the deficit in local creation following the outcome of tempest Harvey.

The normal uptick in crude supplies comes in the midst of a hand over opinion on oil costs in the wake of bullish reports from both the Organization of the Petroleum Exporting Countries (Opec) and International Energy Agency a week ago.

"It appears that at any rate some portion of the current rally in the course of the most recent couple of weeks has been because of more grounded request, all the significant offices modified up their estimates for interest during the current year," said Tom Pugh, wares business analyst at Capital Economics.

Opec is relied upon to proceed with converses with broadening its generation cut assertion past March 2018 out of a push to handle rising yield from Nigeria and Libya – the two nations are absolved from creation checks.

In May, Opec and non-Opec individuals consented to broaden generation cuts of 1.8m barrels for every day for a time of nine months until March 2018.

No comments:

Post a Comment