Oil markets were unstable on Monday, with U.S. rough ascending on creation shutdowns while worldwide Brent was pulled around a flight into gold fates following an intense North Korean atomic test blast.

In the interim, U.S. gas costs (RBc1) dropped once again from a spike after the arrival of crisis fuel stocks and on signs that the harm from Hurricane Harvey to the Gulf drift vitality foundation was not as awful as at first dreaded.

U.S. West Texas Intermediate (WTI) (Clc1) unrefined prospects were at $47.42 barrel at 0411 GMT, 13 pennies over their last settlement.

Dealers said that this value rise was a consequence of rough creation blackouts following Hurricane Harvey.

Around 5.5 percent of the U.S. Inlet of Mexico's oil generation, or 96,000 barrels of day by day yield, stayed close on Sunday, the government Bureau of Safety and Environmental Enforcement said.

In the meantime, refineries that utilization unrefined to make fuel were bit by bit beginning up once more, alongside the pipelines transporting items.

"Merchants are cheerful that rough excesses will be cleared," said Jeffrey Halley, senior market examiner at fates financier OANDA.

All things considered, numerous investigators say it could take a long time before the U.S. oil industry completely recoups from Harvey, and Texas Governor Greg Abbott evaluated harm at $150 billion to $180 billion, calling it more exorbitant than Hurricanes Katrina or Sandy, which hit New Orleans in 2005 and New York in 2012.

Tempest Harvey influenced landfall along the Gulf to shore of Texas and Louisiana a week ago, thumping out just about a fourth of the whole U.S. refining limit, causing a value spike and supply hole for powers like fuel, which merchants around the globe have been scrambling to fill.

Outside the United States, markets were apprehensively peering toward advancements in North Korea, where the military led its 6th and most effective atomic test throughout the end of the week. Pyongyang said it had tried a propelled nuclear bomb for a long-run rocket, inciting the danger of an "enormous" military reaction from the United States in the event that it or its partners were debilitated.

This put descending weight on global Brent rough (LCOc1) as dealers moved cash out of oil - seen as high-chance markets - into gold prospects , generally saw as a place of refuge for financial specialists

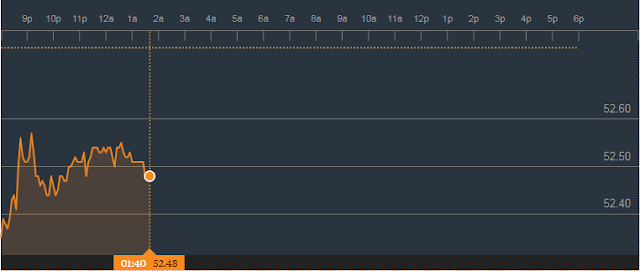

Brent was at $52.54 per barrel, down 21 pennies, or 0.4 percent from the last close.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

Commodity recommendations, commodity tips, Crude Oil tips, crude oil trading signals, gold signals,crude oil trading tips

No comments:

Post a Comment