Oil was unfaltering on Thursday, holding picks up from the past session after another fall in U.S. unrefined inventories demonstrated a more tightly advertise, and as a hurricane was setting out toward oil delivering offices in the Gulf of Mexico.

Brent rough prospects, (LCOc1) the global benchmark at oil costs, were at $52.58 per barrel at 0438 GMT, up 1 penny from their last close.

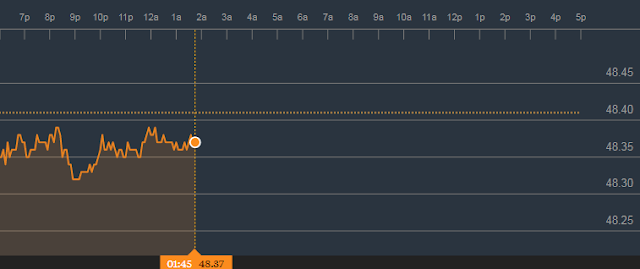

U.S. West Texas Intermediate (WTI) unrefined fats (CLc1) were at $48.37 a barrel, down 4 pennies.

Both unrefined fates contracts climbed more than 1 percent on Wednesday, additionally floated by potential yield interruptions from the Gulf of Mexico storm.

"For the following couple of days, the U.S. showcase will be centered around Texas as the tropical dejection Harvey is relied upon to fortify into a Category I storm by Friday," said Sukrit Vijayakar, chief of vitality consultancy Trifecta in a note.

"Administrators in the range are as of now shutting down stages and clearing laborers as a safeguard," he included.

Harvey fortified into a hurricane late on Wednesday night with winds of around 40 miles for every hour (65 km for each hour) and was situated around 440 miles (705 km) southeast of Port Mansfield, Texas, the U.S. National Hurricane Center announced.

Illustrious Dutch Shell (LON:RDSa), Anadarko Petroleum (NYSE:APC) and Exxon Mobil (NYSE:XOM) have every made move to control some oil and gas yield at stages in the Gulf, the organizations said Wednesday.

Past the climate, dealers said that progressing decreases in U.S. business unrefined capacity levels were an indication of a step by step fixing market, albeit another ascent in yield kept the market down, they said.

"Another solid drawdown in U.S. unrefined petroleum inventories should see oil costs all around bolstered," ANZ bank stated, in spite of the fact that it included that "there was an insight of wariness, with U.S. oil yield proceeding to push higher."

U.S. oil generation hit 9.53 million barrels for every day (bpd) a week ago, the largest amount since July 2015 and up more than 13 percent from their latest low in mid-2016.

In spite of this, U.S. rough stocks fell a week ago and fuel stocks were down also, the Energy Information Administration said on Wednesday.

Unrefined inventories fell by 3.3 million barrels in the week finishing August 18, to 463.17 million barrels, down 13.5 percent from their record levels last March.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

Commodity recommendations, commodity tips, Crude Oil tips, crude oil trading signals, gold signals,crude oil tips

No comments:

Post a Comment