Arguments:

- Gold costs stamp time as business sectors look forward to US work information

- Crude oil costs edge up as EIA reports another stock drawdown

Gold costs slowed down as recognizable talk from Fed authorities and blended flags in July's ADP private-segment business information left rate climb hypothesis rudderless. A baffling feature print was counteracted an update of June's outcome, creating a net change of 21k in respect to standard gauges.

From here, the administration sectorISM overview and additionally manufacturing plant and tough products orders numbers are on tap. Energetic outcomes resounding expansive change in US news-stream since mid-June may weigh against the yellow metal however enduring complete may need to sit tight for Friday's prominent payrolls report.

On the Fed-talk front, St. Louis and Minneapolis branch presidents James Bullard and Neel Kashkari are expected to talk. While their comments will illuminate dealers' general feeling of the FOMC's reasoning, it appears to be far-fetched that a remark sufficiently intense to create quick firecrackers will rise.

Crude oil costs ascended as EIA stock information demonstrated reserves shed 1.53 million barrels a week ago. While this was littler than the 3.1 million draw expected, dealers gave off an impression of being soothed after API anticipated an unexpected form yesterday. A break in top-level occasion hazard may make for solidification in the close term.

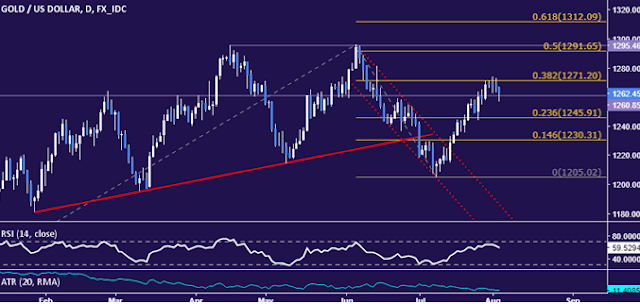

GOLD TECHNICAL ANALYSIS – Gold costs stay at a stop underneath the 38.2% Fibonacci expansionat 1271.20. Breaking over this boundary on a day by day shutting premise uncovered the 1291.65-95.46 zone (half level, twofold best). Then again, an inversion underneath expression point bolster at 1260.85 opens the entryway for a retest of the 23.6% Fib at 1245.91.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil costs dealt with a skip from help at 48.65, the 50%Fibonacci retracement. From here, an every day close over the 61.8%levelat 50.19 uncovered the 76.4% Fib at 52.11. On the other hand, a turn underneath help makes ready for another test of the 47.10-29 range (38.2% retracement, July 4 high).

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

No comments:

Post a Comment