The overnight auction in the American dollar pushed the greenback to a new 14-month low of 92.78 against a wicker bin of monetary standards. Still gold costs stay level lined, apparently due to stangant yield bend and overbought specialized conditions.

The yellow metal stays level lined $1268/Oz levels. It hit a crisp 1-1/2 month high of $1271.17 however rapidly came up short on steam. The terrible execution in the wake of an expansive based USD auction could be expected to overbought specialized conditions.

The Treasury yield bend - the distinction or the spread between the 10-yr yield and the 2-yr yield has stayed unaltered around 95 premise focuses. Henceforth, the USD auction should be brought with a squeeze of salt. Besides, the greenback is oversold on the specialized diagrams also.

Concentrate on US individual spending

Individual spending due at 12:30 GMT is relied upon to come-in at 0.1%, while the development in salary is seen easing back to 0.3% from the earlier month's print of 0.4%. A superior than-anticipated individual spending may help USD and weigh over gold.

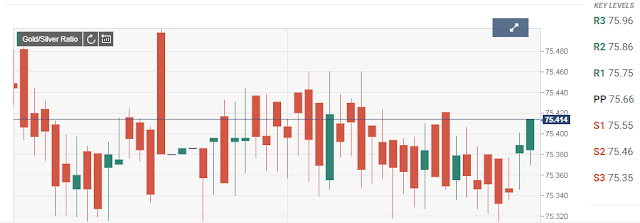

Gold Technical Levels

The quick resistance is seen at $1271.17 in front of $1274.54 - 76.4% Fib R of June 2017 high - July 2017 low and $1281.16 - June 14 high. On the drawback, bolster is seen at break of help at $1265.60 - earlier day's low, would open entryways for an auction to $1257.59 - July 28 low and $1254.70 - July 27 low.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

No comments:

Post a Comment