TOKYO (Reuters) - Oil fates crept down on Thursday in spite of authority figures indicating U.S. crude inventories fell more than anticipated, with an investigator saying the market had sunk into a range.

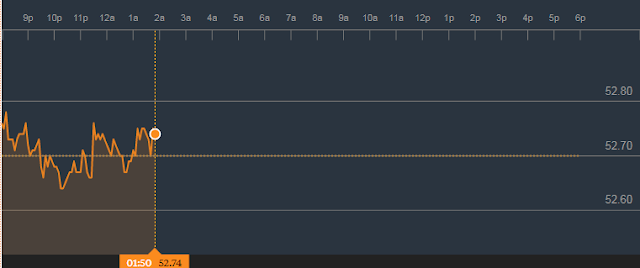

Brent crude, the worldwide benchmark, was down 4 pennies, or 0.1 percent, at $52.66 at around 0232 GMT, after prior exchanging as high as $52.80. It quit for the day percent on Wednesday, snapping two days of decays.

U.S. West Texas Intermediate (WTI) crudecrude was down 3 pennies at $49.52, in the wake of ascending to $49.69 prior. The agreement increased 0.8 percent in the past session.

"We have subsided into a range. The U.S. dollar is somewhat more grounded, which might be making a touch of pessimism, however extensively I think the market is exchanging sideways right now," said Ric Spooner, boss market investigator at CMC Markets in Sydney.

U.S. rough reserves fell a week ago as refineries helped yield to the most astounding level of limit in 12 years, the Energy Information Administration said on Wednesday.

U.S. oil inventories dropped by 6.5 million barrels a week ago, the administration information appeared, more extreme than the normal decline of 2.7 million barrels.

"It creates the expectation that we will end the late spring driving season with inventories underneath the prior year, which would be a positive improvement," Spooner said.

Refiners prepared about 17.6 million barrels of unrefined, outperforming a record set in May and the most for any week since the U.S. Branch of Energy began keeping information in 1982.

Be that as it may, an unexpected increment in gas stocks is topping additions in oil costs and treating endeavors by the Organization of the Petroleum Exporting Countries (OPEC), Russia and different makers to help costs that are about portion of levels three years back.

They are cutting yield by around 1.8 million barrels for each day (bpd) under an understanding set to keep running until March 2018.

The arrangement has upheld costs however a recuperation in yield in Libya and Nigeria, OPEC individuals excluded from the cut, has likewise entangled the activity.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

No comments:

Post a Comment