Crude oil costs bounced back in Asia on Thursday as financial specialists saw purchasing opportunity on an overnight plunge on blended U.S. stock information.

Record refinery keeps running in the U.S. are drawing down rough stocks, however gas created is not seeing expected solid request as the mid year driving season heads to a nearby, said Matt Smith, chief of wares, Clipper Data.

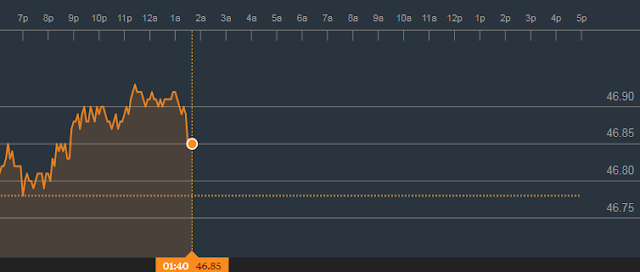

On the New York Mercantile Exchange rough prospects for September conveyance rose 0.24% to $46.89, while on London's Intercontinental Exchange, Brent increased 0.44% to $50.49 a barrel.

Overnight, unrefined prospects settled lower on Wednesday, as information demonstrating U.S. rough generation rose to its most elevated in more than two years balance a decrease in provisions of U.S. rough for a seventh-straight week.

Crude oil fell for the third-straight day, after a report from the Energy Information Administration (EIA) indicating unrefined reserves fell by more than anticipated a week ago neglected to balance worries over an ascent underway.

Inventories of U.S. Crude fell by approximately 8.9m barrels in the week finished Aug 11, puzzling desires of a draw of about just 3m barrels. It was seventh-straight seven day stretch of falling rough inventories.

Gas inventories, one of the items that Crude is refined into, startlingly ascended by around 22,000 barrels against desires of a draw of 1.1m barrels while distillate reserves ascended by 702,000 barrels, contrasted with desires of a decay of 572,000 barrels.

The report likewise featured aggregate Crude oil generation rose to 9.502m barrels for each day, an uptick of 79,000 barrels a day contrasted with a week ago. That was the most elevated week after week yield figure since mid-July 2015, and started new oversupply butterflies, constraining oil costs.

The ascent in gas reserves, additionally added to oversupply worries, as experts expect rough request will decrease as the pinnacle of summer driving season has passed.

To know our latest Recommendation or Crude Oil signals along with stop loss and target price visit :-

Commodity recommendations, commodity tips, Crude Oil tips, crude oil trading signals, gold signals

No comments:

Post a Comment